A while back, a friend told me about ANDY on Ethereum, and after looking at ANDY’s chart and its dynamics, I found it quite interesting. This member of the Boy’s Club rapidly, almost instantaneously, increased its market capitalization (MCAP) from nearly $300K to a staggering $297 million in about 70 days. ANDY is the main token among several similarly named tokens on other chains, although none of the others have made their way into the top 500 MCAP tokens.

With the help of Dune Analytics, I aimed to shed some light on the general dynamics behind this phenomenon. Since it’s nearly impossible to download data using Dune Analytics’ free plan, I leveraged their SQL engine to retrieve the data and create the charts directly on their platform. As a result, I wasn’t able to generate every chart I wanted :( but I’m still quite happy with the results. (You can see the specific amounts in the interactive charts on the Dune dashboard.)

Let’s dive into it! :)

Price Charts

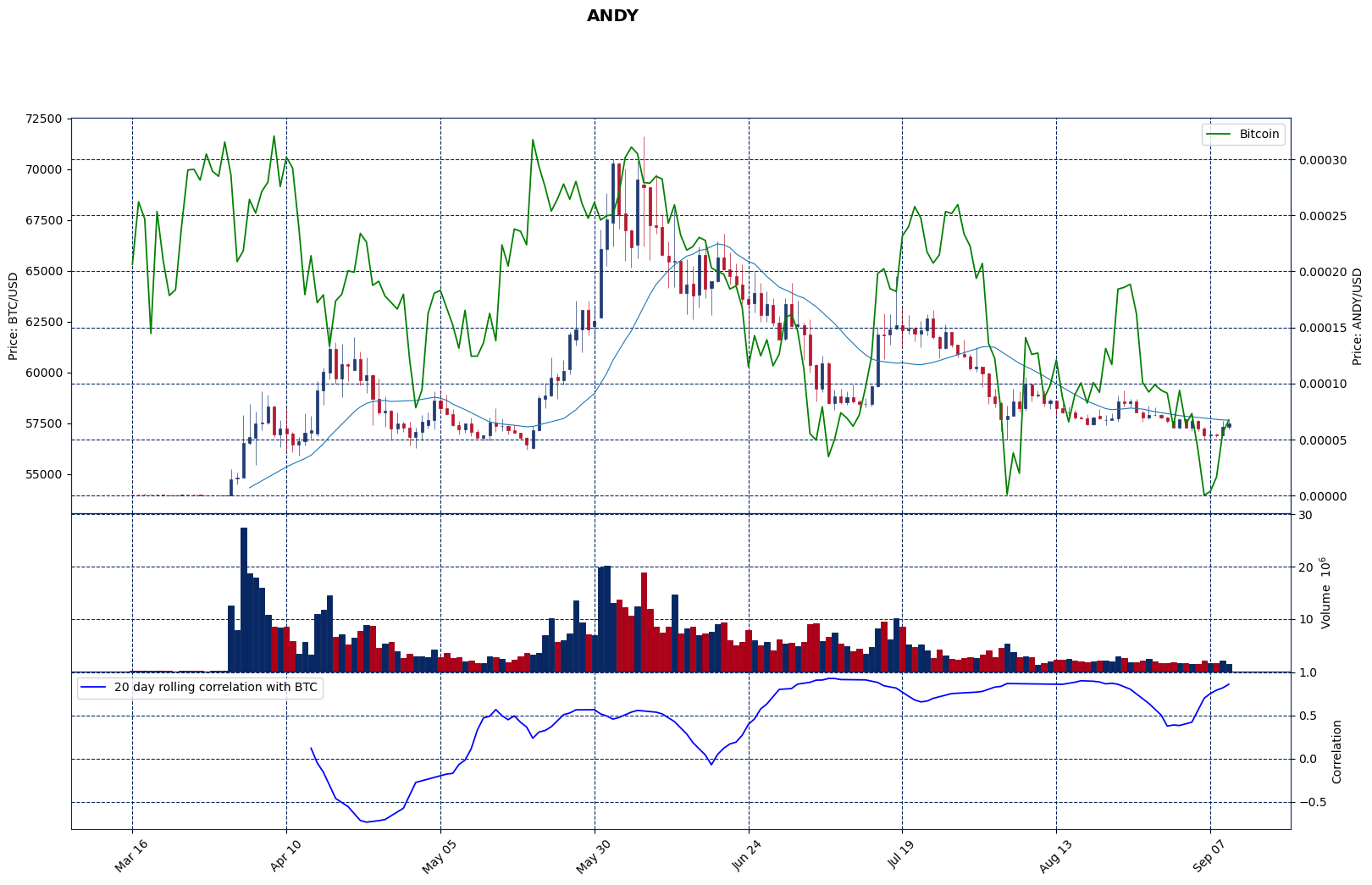

Below is ANDY’s price and volume chart, with data sourced from the CoinMarketCap.com WebAPI.

# Import packages

import matplotlib.pyplot as plt

import requests

import json

import pandas as pd

import datetime

import time

import mplfinance as mpf

import numpy as np

# Ids and links

BTC_ID = 1

ANDY_ID = 29879

USD_ID = 2781

start = datetime.datetime(2024, 3, 8)

start_UNIX = int(time.mktime(start.timetuple()))

end = datetime.datetime(2024, 9, 11)

end_UNIX = int(time.mktime(end.timetuple()))

API_address = 'https://api.coinmarketcap.com/data-api/v3/cryptocurrency/historical?'

BTC_url = f"{API_address}id={BTC_ID}&convertId={

USD_ID}&timeStart={start_UNIX}&timeEnd={end_UNIX}"

ANDY_url = f"{API_address}id={ANDY_ID}&convertId={

USD_ID}&timeStart={start_UNIX}&timeEnd={end_UNIX}"

# getting data

# BTC

r = requests.get(ANDY_url)

data = []

cols = ['Open', 'High', 'Low', 'Close', 'Volume', 'date']

for item in r.json()['data']['quotes']:

Open = item['quote']['open']

High = item['quote']['high']

Low = item['quote']['low']

Close = item['quote']['close']

Volume = item['quote']['volume']

date = item['quote']['timestamp']

data.append([Open, High, Low, Close, Volume, date])

data_ANDY = pd.DataFrame(data, columns=cols)

data_ANDY['date'] = pd.to_datetime(data_ANDY['date'])

data_ANDY['date'] = data_ANDY['date'].dt.date

data_ANDY['date'] = pd.to_datetime(data_ANDY['date'])

print(data_ANDY)

P_ANDY = data_ANDY.set_index('date')

# ANDY

r = None

r = requests.get(BTC_url)

data = []

cols = ['Open', 'High', 'Low', 'Close', 'Volume', 'date']

for item in r.json()['data']['quotes']:

Open = item['quote']['open']

High = item['quote']['high']

Low = item['quote']['low']

Close = item['quote']['close']

Volume = item['quote']['volume']

date = item['quote']['timestamp']

data.append([Open, High, Low, Close, Volume, date])

data_BTC = pd.DataFrame(data, columns=cols)

data_BTC['date'] = pd.to_datetime(data_BTC['date'])

data_BTC['date'] = data_BTC['date'].dt.date

data_BTC['date'] = pd.to_datetime(data_BTC['date'])

print(data_BTC)

P_BTC = data_BTC.set_index('date')

# 30D rolling corr

window_size = 30

rolling_corr = P_ANDY['Close'].rolling(window=window_size).corr(P_BTC['Close'])

print(rolling_corr)

The chart suggests that before March 31st, both volume and prices were low, and the volume was negligible in absolute terms compared to what it would become. In early June, it began to behave similarly to Bitcoin (green line), though prior to that, it clearly followed a different trend. The 30-day moving window correlation chart also shows very high values by the end of June, and this generally remains consistent. In early June, after the second major surge in volume and the decrease in Bitcoin’s value, ANDY followed a similar downward pattern.

Dune Analytics Datasets And Dashboard

All the charts in this section are thanks to Dune Analytics. You can view my dashboard for this analysis here. On the dashboard, the charts are more visually appealing and interactive <3.

I used several criteria to create these charts:

1. The minimum buy value is set around $70.

2. Prices are based on hourly averages on DEX.

3. The maximum number of buys per wallet is 100.

4. Users must have at least covered their buy value in realized profit.

When Did It Become Serious?

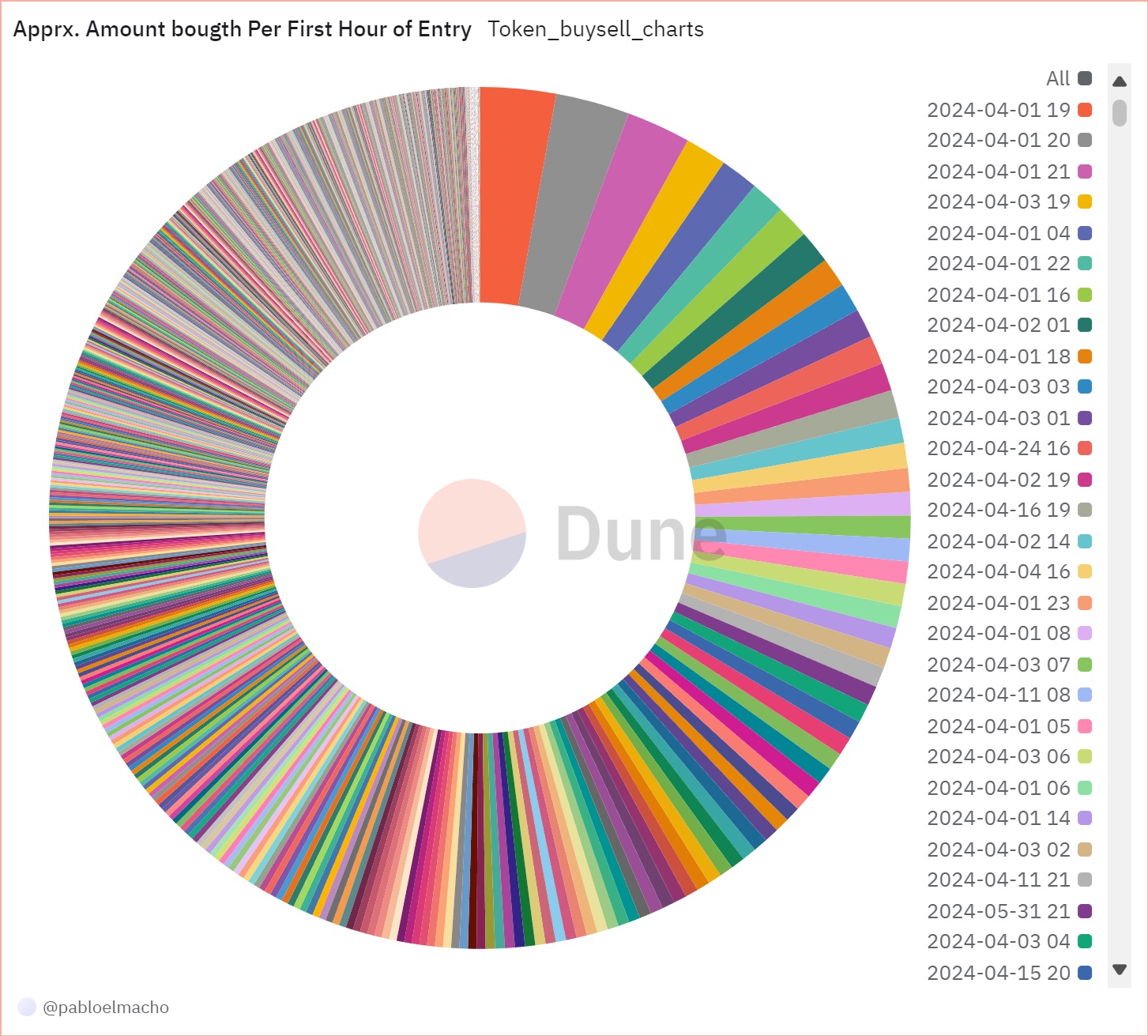

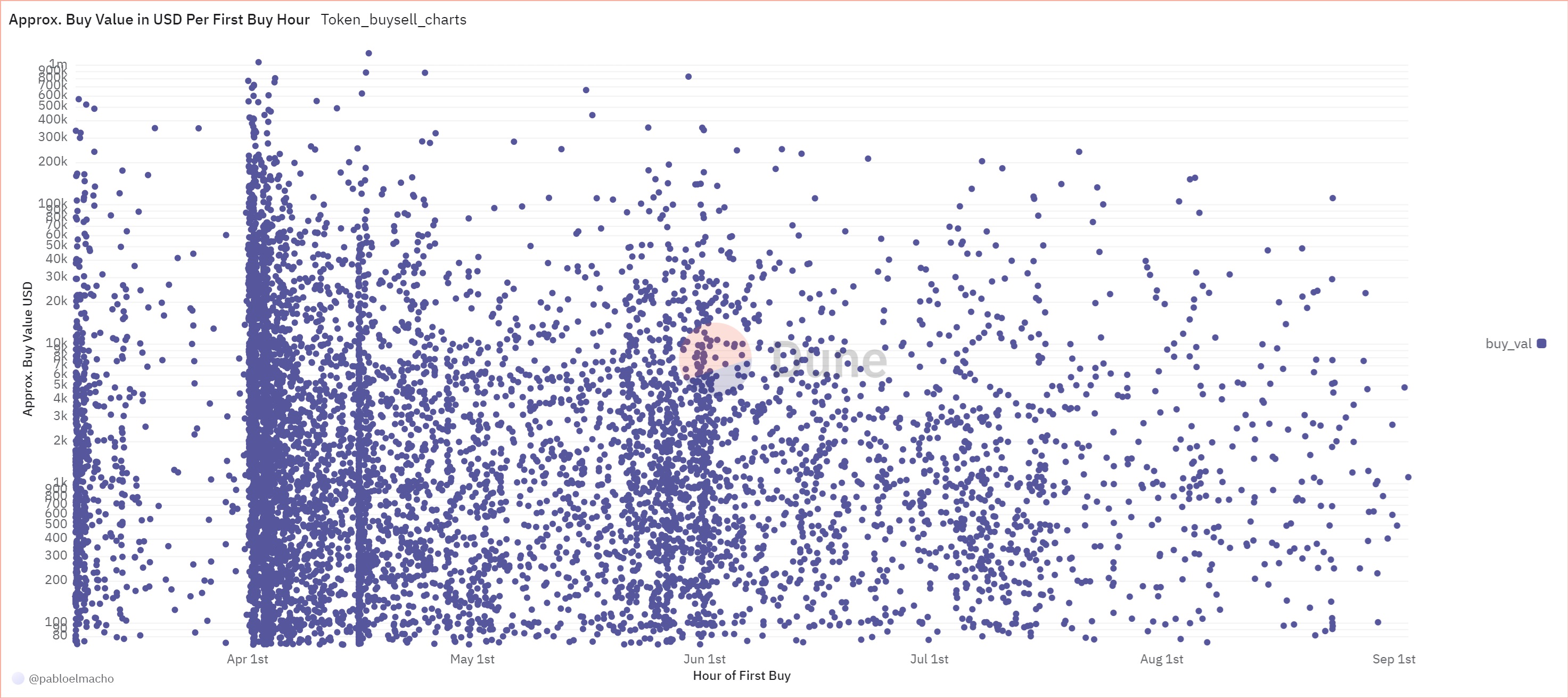

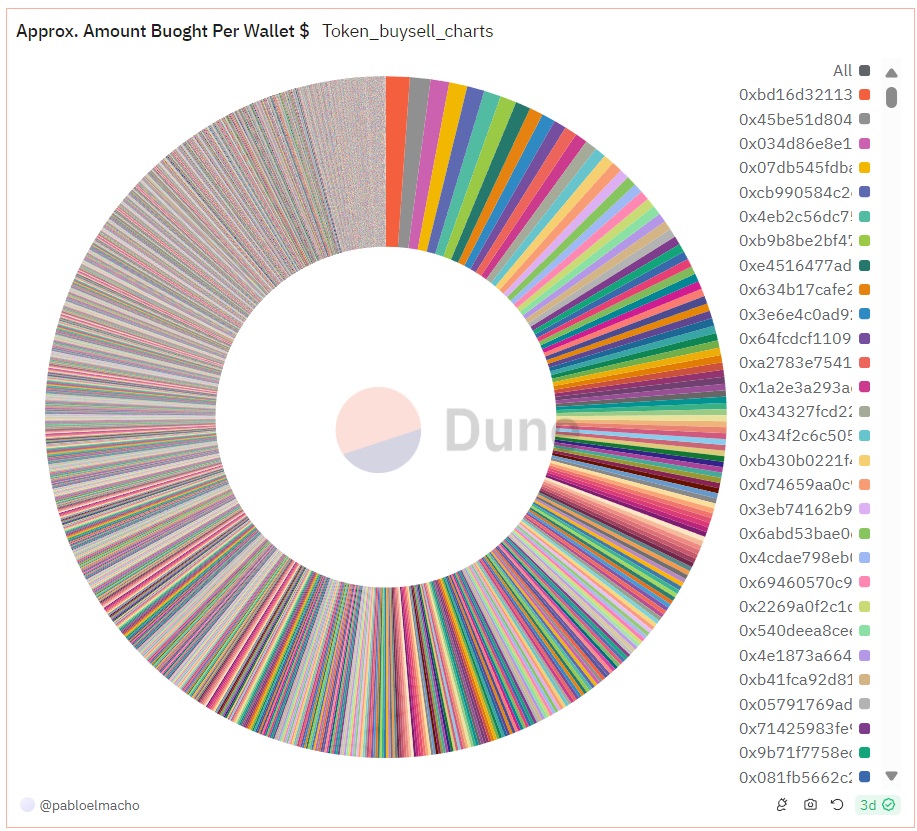

As the above chart shows, there is a significant bump in the amount bought on the 1st of September, between 16:00 and 21:00. Earlier on the same day, there was a smaller surge between 04:00 and 06:00. The next chart shows the approximate amount bought per wallet in USD, with the horizontal lines indicating when each wallet first purchased ANDY. Those who first entered in early April bought significantly more than the rest, even more than those who entered after ANDY’s launch. Besides these two groups, there are two other notable groups of wallets: the first around the third week of April, just as the token reached a local high, and the second in late May, when the token began an upward movement that mirrored Bitcoin’s rise, albeit with a slight lag, and ended around the time Bitcoin started to decline.

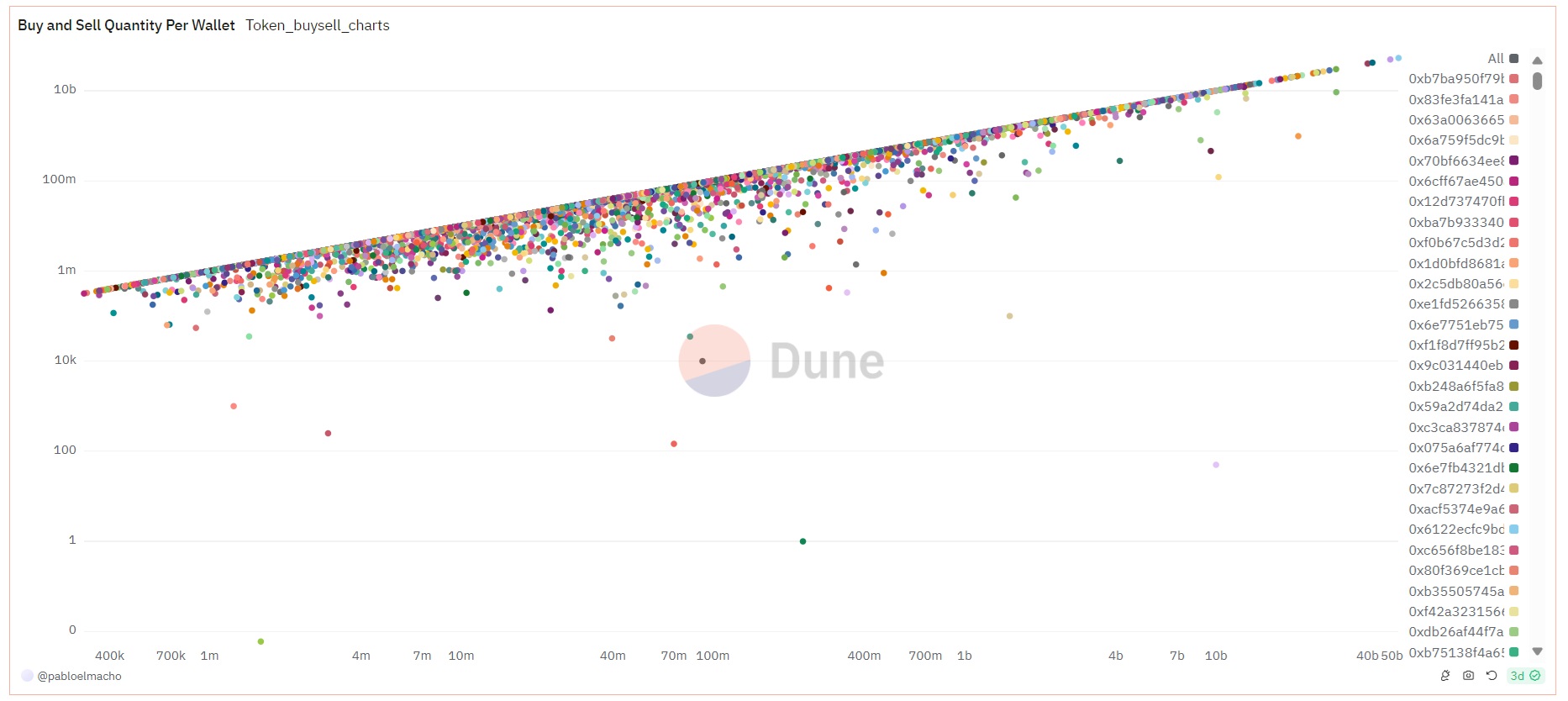

Buy and Sell Per Wallet

This chart shows the amount bought and sold per wallet. Most of the wallets sold the majority of their holdings during this 7-month period. Wallets that bought larger quantities seem to hold onto less in their balances. The next pie chart illustrates the buy and sell quantities per wallet. Approximately one-third of the overall quantity purchased is by wallets who significantly bought larger quantities compared to the others. Dune dashboard.

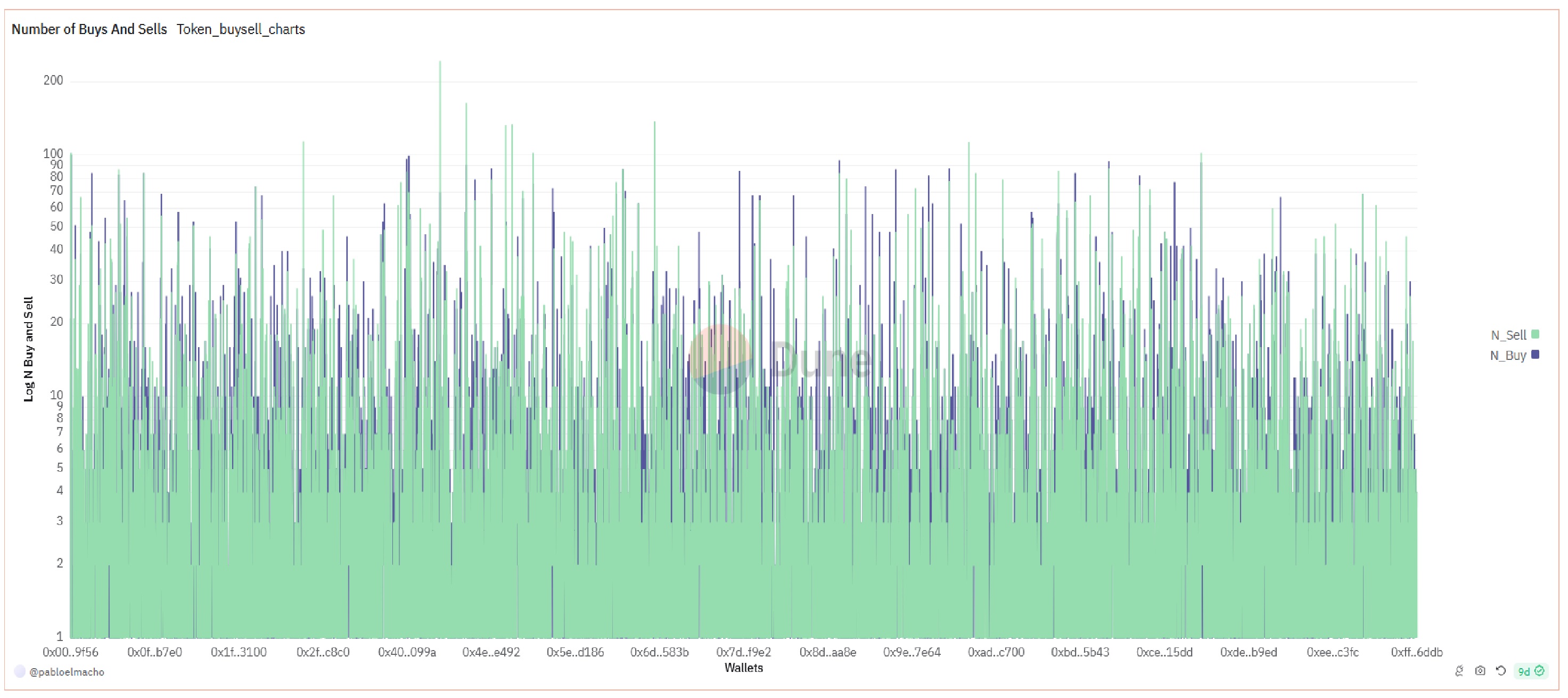

The following two charts show the number of buys and sells per wallet, indicating how many times a wallet bought and sold. At the beginning, as we said, we set criteria to exclude wallets that bought more than 100 times. This helps filter out day traders and bots.

The data suggests that the

majority of wallets had fewer than 20 buy or sell transactions. Since

the higher values on the chart are dominated by the green color, it

indicates that most wallets sold more frequently than they bought.

The data suggests that the

majority of wallets had fewer than 20 buy or sell transactions. Since

the higher values on the chart are dominated by the green color, it

indicates that most wallets sold more frequently than they bought.

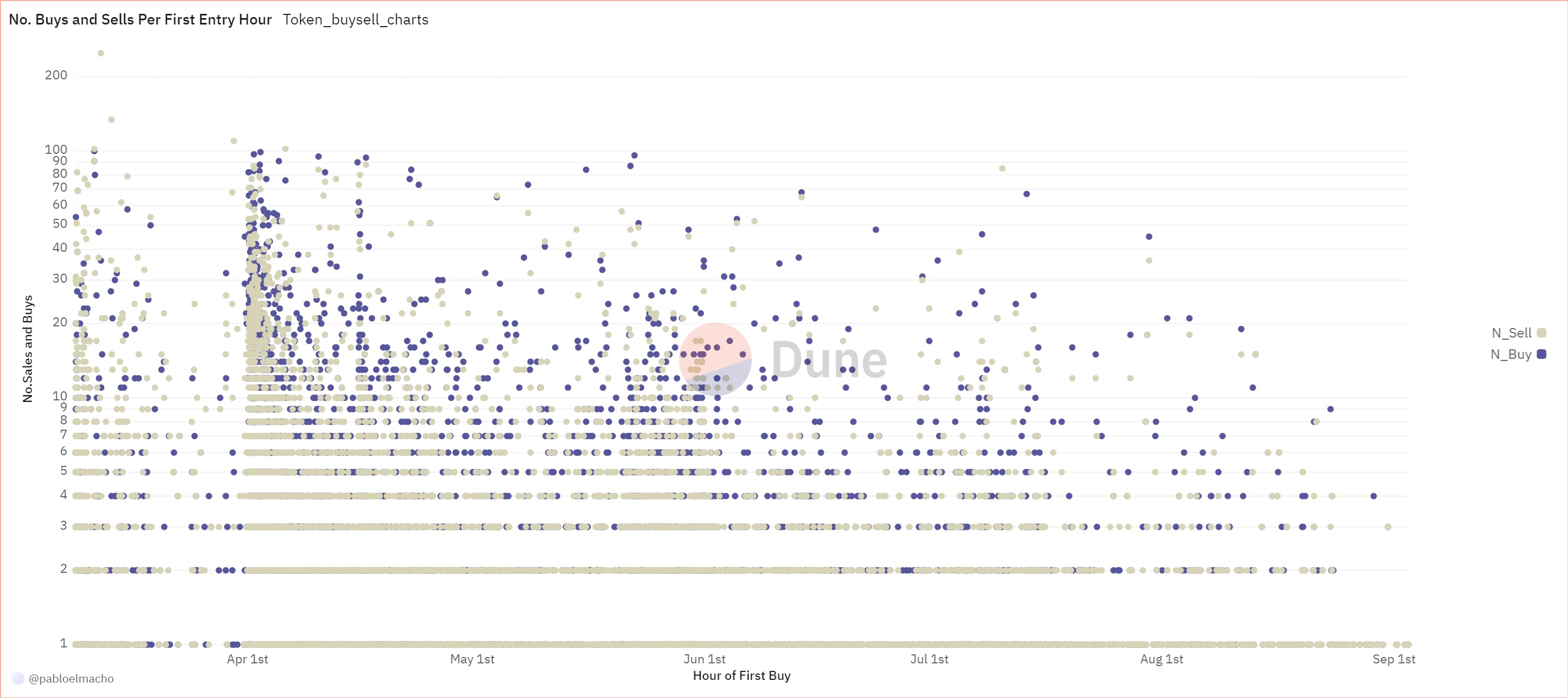

This chart shows the

number of sells per wallet and the number of buys per wallet based on

when they first purchased ANDY. (To my knowledge, Dune does not support

3D charts, but these charts certainly deserve one!) This chart suggests

two interesting observations:

This chart shows the

number of sells per wallet and the number of buys per wallet based on

when they first purchased ANDY. (To my knowledge, Dune does not support

3D charts, but these charts certainly deserve one!) This chart suggests

two interesting observations:

First, wallets that entered in early and mid-April show a considerably higher number of buys and sells. This implies that most of these wallets were likely not owned by informed players. However, I cannot say the same for wallets that entered between ANDY’s launch and the end of May.

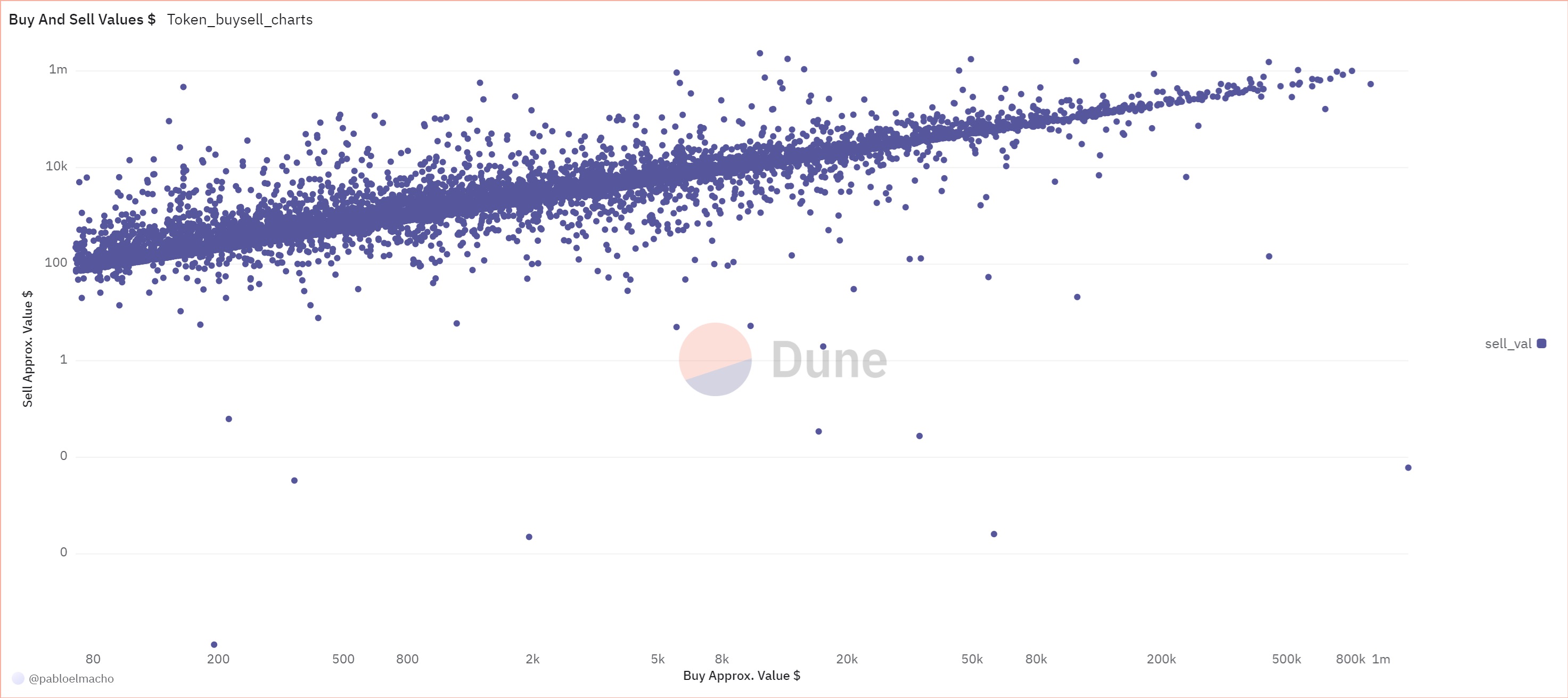

For all charts, we separated

wallets where the average selling price was higher than their average

buying price. From these results, we can observe that buy values are

generally lower than sell values. Some wallets held onto a portion of

their tokens and did not sell them. The chart is logarithmic, which

suggests that not many made exceptional profits (in terms of USD. I made some other profit related charts bellow). Many

wallets seemed content with profits around $10K. Wallets that bought

more than $50K worth of tokens did not behave outside the norm, and with

a few exceptions, the same can be said for wallets that bought more than

$20K. In short, these wallets do not appear to belong to particularly

informed or lucky players.

For all charts, we separated

wallets where the average selling price was higher than their average

buying price. From these results, we can observe that buy values are

generally lower than sell values. Some wallets held onto a portion of

their tokens and did not sell them. The chart is logarithmic, which

suggests that not many made exceptional profits (in terms of USD. I made some other profit related charts bellow). Many

wallets seemed content with profits around $10K. Wallets that bought

more than $50K worth of tokens did not behave outside the norm, and with

a few exceptions, the same can be said for wallets that bought more than

$20K. In short, these wallets do not appear to belong to particularly

informed or lucky players.

Sells and Realized Profit

In this section, we examine the ratio of sold tokens to bought tokens and the realized profit, which reflects the profit rate on the tokens sold. What I love most about crypto is that profit rates are often expressed as multiples (X) rather than percentages :D Well, as the saying goes, mega profits are better than micro losses.

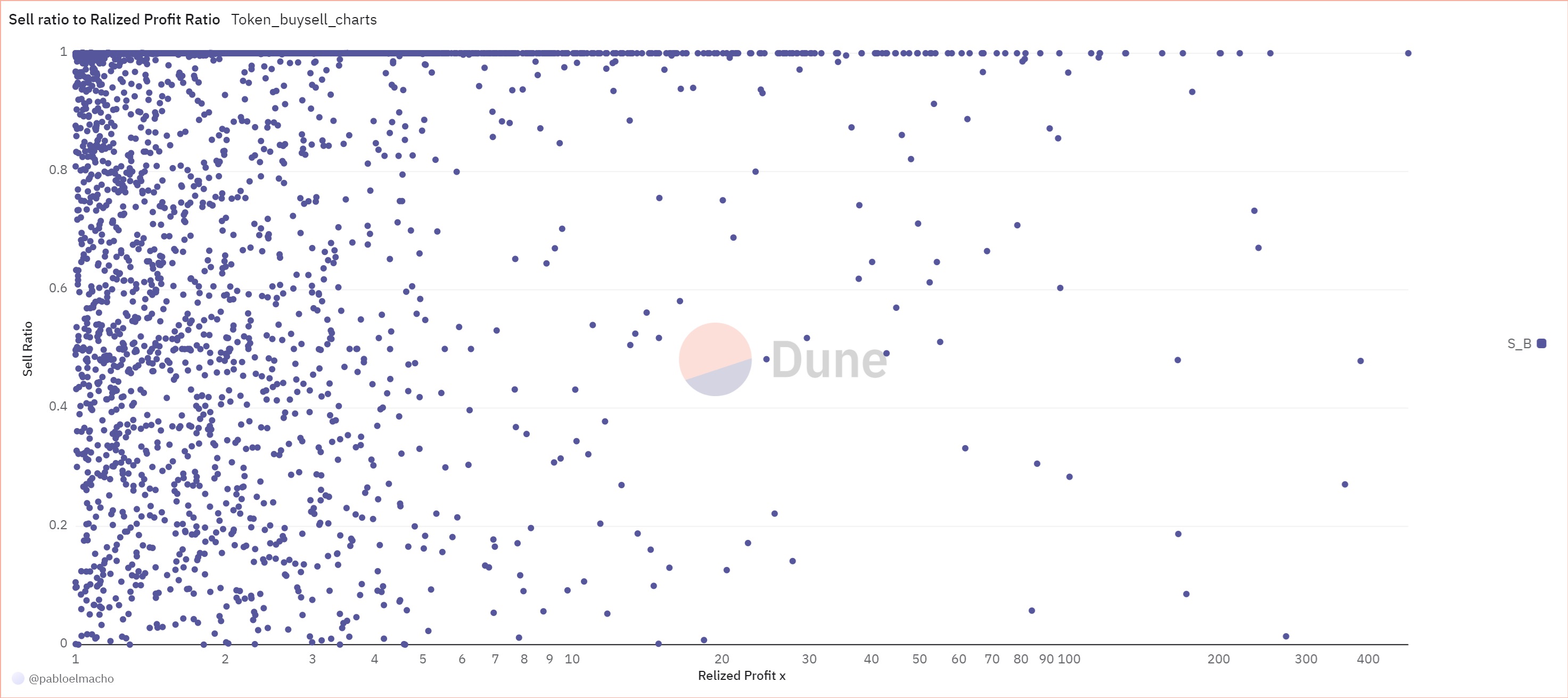

The chart of

sell ratio to realized profit suggests that the greater the profit

amount, the less a wallet retained its tokens. Additionally, few wallets

achieved more than a 20X realized profit.

The chart of

sell ratio to realized profit suggests that the greater the profit

amount, the less a wallet retained its tokens. Additionally, few wallets

achieved more than a 20X realized profit.

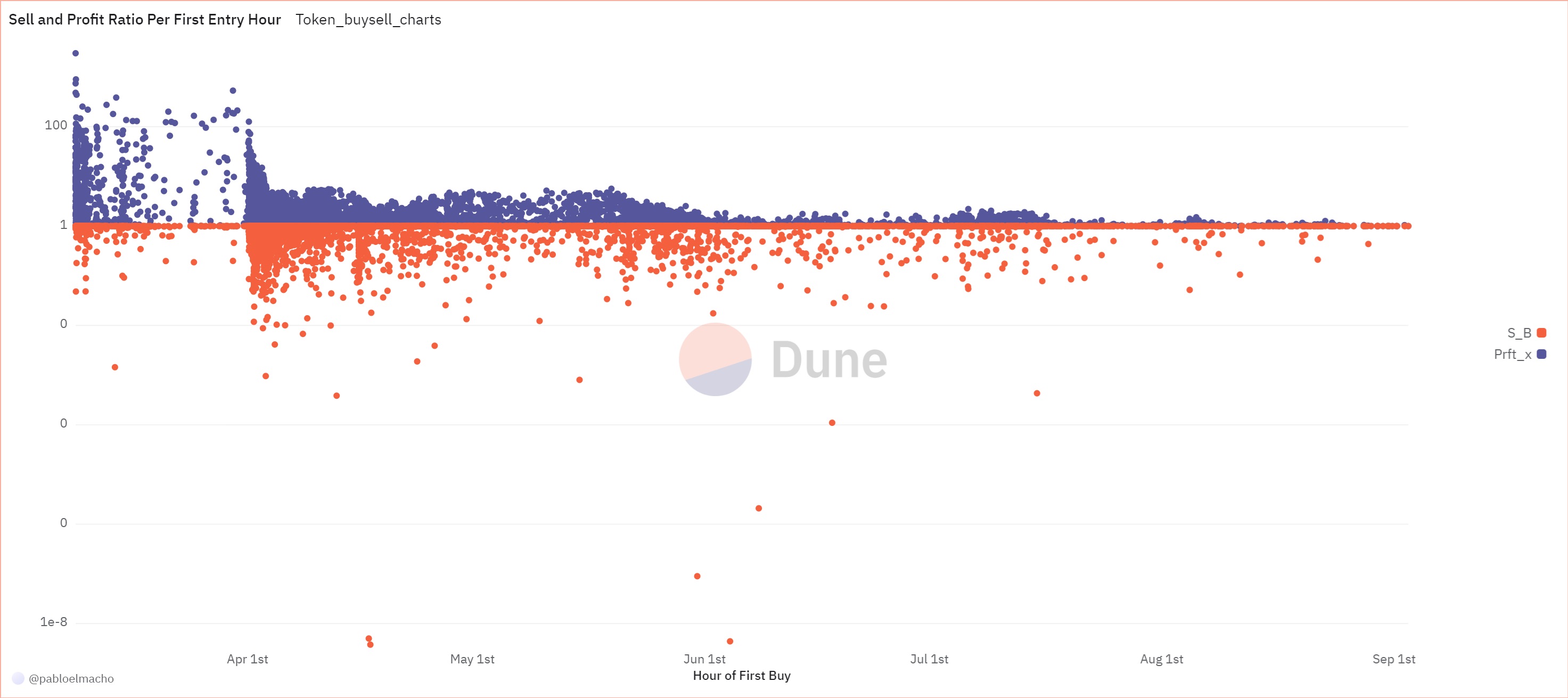

The

chart showing sell and realized profit based on the initial entry into

the market indicates that early buyers, particularly those in May and

the first three days of April, are the ones who achieved more than a 10X

profit. These wallets are mostly concentrated in the initial days of

April or immediately after the launch. The second group, who entered

later, seems to have retained less of their original tokens. Generally,

people who entered after April 1st and met the selection criteria

retained more tokens than earlier holders. Overall, the most active

wallets sold almost all they bought, while most of the holders kept less

than 20% of their purchases.

The

chart showing sell and realized profit based on the initial entry into

the market indicates that early buyers, particularly those in May and

the first three days of April, are the ones who achieved more than a 10X

profit. These wallets are mostly concentrated in the initial days of

April or immediately after the launch. The second group, who entered

later, seems to have retained less of their original tokens. Generally,

people who entered after April 1st and met the selection criteria

retained more tokens than earlier holders. Overall, the most active

wallets sold almost all they bought, while most of the holders kept less

than 20% of their purchases.

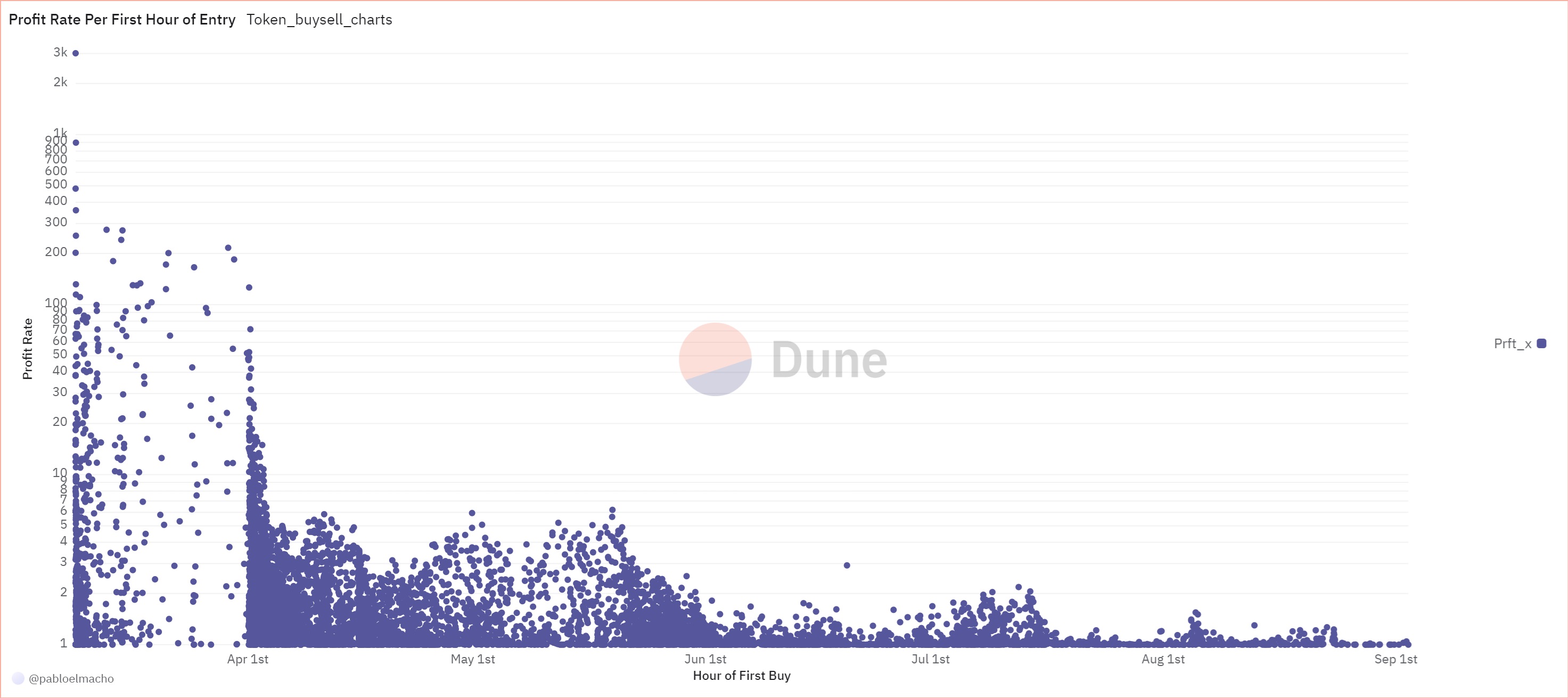

The chart showing

realized profit based on the first time of entry is particularly

striking. It reveals that profits exceeding 6X are almost exclusively

associated with wallets that first bought ANDY before April 3rd. Those

who purchased during the semi-trend period on X and Telegram also seem

to be among those who made more than 6X profit. Some wallets that bought

before this time achieved considerable profit rates, suggesting they

were possibly either very informed, happy, or had a strategic plan. Most of these

wallets made less than 200X profit, although one early wallet achieved a

remarkable 3000X.

The chart showing

realized profit based on the first time of entry is particularly

striking. It reveals that profits exceeding 6X are almost exclusively

associated with wallets that first bought ANDY before April 3rd. Those

who purchased during the semi-trend period on X and Telegram also seem

to be among those who made more than 6X profit. Some wallets that bought

before this time achieved considerable profit rates, suggesting they

were possibly either very informed, happy, or had a strategic plan. Most of these

wallets made less than 200X profit, although one early wallet achieved a

remarkable 3000X.

Conclusion

Initially, ANDY’s performance was unremarkable, but a sudden surge on April 1st marked the beginning of significant buying activity. The token increased in value and subsequently followed Bitcoin’s trajectory with a delay, reaching a peak. Afterward, it showed a high 30-day moving window correlation with Bitcoin.

I found these dynamics fascinating, which prompted me to investigate further. I selected wallets based on specific criteria to analyze their overall behavior. Some wallets that bought ANDY before April 3rd achieved more than 6X profits, though their numbers are limited compared to the total number of ANDY buyers. Most of the wallets we considered sold almost all of their holdings, while the remainder kept less than 20% of their purchases.

Although I haven’t quantified it, these patterns seem to be related to ANDY’s Telegram channel and X hashtag activity. If I find a relevant dataset, I might explore this further in the future. Additionally, I found Dune Analytics to be a very useful tool! :) I also used ChatGPT for editing and some Python’s function searches, which significantly boosted my productivity. And I felt slightly outdated after using it :D