Momentum part 2

In the previous post on the same subject the results showed momentum with 3 month window that excludes last month was promising for further considerations. In this post I try to consider Small vs. big filtration before making momentum portfolio.

Data

In the last post we get some fundamental data by RSelenium, lets clean it and use it. First the “,” character that in some Persian websites is used for separating every 3 number need to be deleted. After that number of shares need to be multiplied by 1000 to become book value. After deleting duplicates and matching the data, I use diagonal of outer product of shares market value and book value to get the Mcap at end of each month.

data.TSE.VALUE<- read.csv( "C:/Users/msdeb/Documents/Data analysis table and R results/data TSE VALUE.CSV")

# deletin ","

data.TSE.VALUE$MCAP<- as.character( data.TSE.VALUE$MCAP)

data.TSE.VALUE$MCAP<- gsub( ",", "", as.character( data.TSE.VALUE$MCAP))

data.TSE.VALUE$MCAP<- as.numeric(data.TSE.VALUE$MCAP)

data.TSE.VALUE$BookValue<- as.character(data.TSE.VALUE$BookValue)

data.TSE.VALUE$BookValue<- gsub(",", "", as.character(data.TSE.VALUE$BookValue))

# number of shares times 1000

data.TSE.VALUE$BookValue<- as.numeric(data.TSE.VALUE$BookValue) * 1000

# selecting matched cases

Bval <- t ( data.TSE.VALUE[,"BookValue"])

colnames(Bval)<- data.TSE.VALUE$sym

match.names<- colnames(Bval)[ colnames(Bval) %in% colnames(retDATAw.mont)]

match.names<- match.names[ !duplicated(match.names)]

Bval.sel<- Bval[ , match.names]

Bval.sel<- rbind(Bval.sel)

retDATAw.mont.sel<- retDATAw.mont[ ,colnames(retDATAw.mont) %in% colnames(Bval.sel)]

retDATAw.mont.sel<- retDATAw.mont.sel[ , match(colnames(Bval.sel), colnames(retDATAw.mont.sel))]

# getting Mcap

Mcap.sel<- matrix( NA, nrow = nrow(retDATAw.mont.sel), ncol = ncol(retDATAw.mont.sel))

for ( i in 1 : nrow( retDATAw.mont.sel)){

Mcap.sel[i,]<- diag (as.numeric(retDATAw.mont.sel[i,]) %o% as.numeric(Bval.sel) ) / 1000

}

colnames(Mcap.sel)<- colnames((retDATAw.mont.sel))

retDATAw.mont.sel$DATE<- retDATAw.mont$DATE

It should be noted that I assumed that number of outstanding shares are constant, which is not a plausible assumption. Given the problems I mentioned in last post I decided this manner. Another important matter is that since I reduced the stocks to listed tradable stocks and not all the stocks that are tradable, and since some data was discountinious, the data and analysis are subject to from survivorship bias.

A slightly different version of last post function, which now filters based on small vs big is used for getting the symbol names:

names.momentum <- function(data = retDATAw.mont.sel,

Mcap = Mcap.sel,

WDATA. = WDATA,

win.back = 12, # backward window for computing return

win.start = 134, # starting raw for computation

last.month = TRUE, # whether to skip latest month

data_NA_rm. = data_NA_rm,

portion.mom = 3 / 10, # portion of stocks to be short or long

n.var = 3 / 4 # portion of stocks to be considered based on volume

) {

DATE.end <- data$DATE[win.start]

if (last.month == TRUE) {

WDATA. <- subset(WDATA., WDATA.$DATE <= data$DATE[win.start] &

WDATA.$DATE > data$DATE[win.start - win.back])

data <- subset(data, data$DATE <= data$DATE[win.start] &

data$DATE > data$DATE[win.start - win.back])

} else{

WDATA. <- subset(WDATA., WDATA.$DATE < data$DATE[win.start] &

WDATA.$DATE >= data$DATE[win.start - win.back])

data <- subset(data, data$DATE < data$DATE[win.start] &

data$DATE >= data$DATE[win.start - win.back])

}

WDATA. <- ddply(WDATA., 'sym', .fun = function(x) data_NA_rm.(x),

.progress = "tk")

WDATA.$sym <- droplevels(WDATA.$sym)

Ave_year_VOL <- summarise(group_by(WDATA., sym), mean = mean(VOL, na.rm = TRUE))

Ave_year_VOL <- Ave_year_VOL[order(Ave_year_VOL$mean , decreasing = TRUE), ]

Ave_year_VOL <- as.data.frame(Ave_year_VOL)

Ave_year_VOL[, 1] <- as.character(Ave_year_VOL[, 1])

portion <- floor(n.var * dim(Ave_year_VOL)[1])

portion <- as.numeric(portion)

portion.sym <- c(Ave_year_VOL[(1:portion) , 1])

Mcap.row<- Mcap[win.start,][ !is.na(Mcap[win.start,])]

Mcap.row<- Mcap.row[ (names(Mcap.row) %in% as.factor(portion.sym))]

Small.Mcap<- names( Mcap.row[ Mcap.row <= median (Mcap.row)])

Big.Mcap<- names( Mcap.row[ Mcap.row > median (Mcap.row)])

data <- data[, (colnames(data) %in% as.factor(portion.sym))]

period.ret <- ( data[dim(data)[1], ] - data[1, ]) / data[1, ]

period.ret.Small<- period.ret[, (colnames(period.ret) %in% as.factor(Small.Mcap))]

period.ret.Small <- period.ret.Small[order(period.ret.Small , decreasing = TRUE)]

is.na.order <- apply(period.ret.Small, 2, function(x) sum(is.na(x)))

period.ret.Small <- period.ret.Small[, which(is.na.order <= 0)]

period.ret.Small <- as.data.frame(names(period.ret.Small))

period.ret.Small[, 1] <- as.character(period.ret.Small[, 1])

n.total.Small <- dim(period.ret.Small)[1]

n.sym.Small <- floor(portion.mom * n.total.Small)

period.ret.Big<- period.ret[, (colnames(period.ret) %in% as.factor(Big.Mcap))]

period.ret.Big <- period.ret.Big[order(period.ret.Big , decreasing = TRUE)]

is.na.order <- apply(period.ret.Big, 2, function(x) sum(is.na(x)))

period.ret.Big <- period.ret.Big[, which(is.na.order <= 0)]

period.ret.Big <- as.data.frame(names(period.ret.Big))

period.ret.Big[, 1] <- as.character(period.ret.Big[, 1])

n.total.Big <- dim(period.ret.Big)[1]

n.sym.Big <- floor(portion.mom * n.total.Big)

names.long <- c( period.ret.Small[1:n.sym.Small,],

period.ret.Big[1:n.sym.Big,])

names.short <- c( period.ret.Small[((n.total.Small - n.sym.Small + 1):n.total.Small),],

period.ret.Big[((n.total.Big - n.sym.Big + 1):n.total.Big),])

out <- list(

win.start = win.start,

DATE = DATE.end,

names.long = names.long,

names.short = names.short

)

return(out)

}

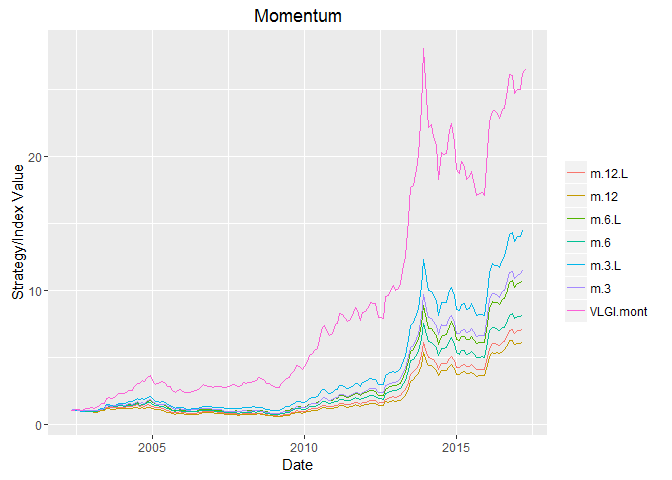

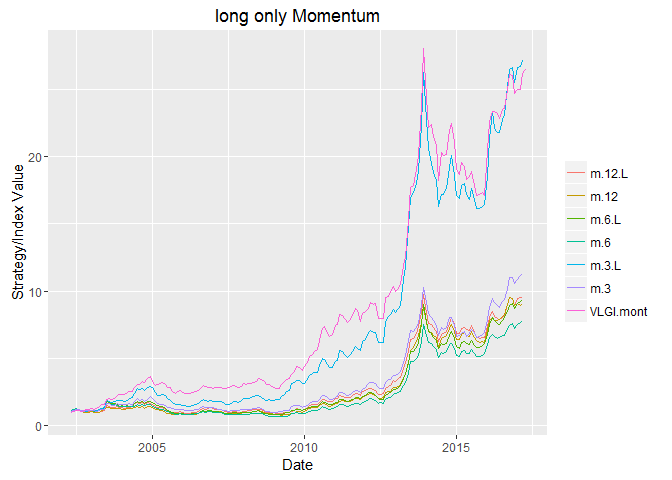

Using the same functions as before we get the following two charts:

Conclusion

Here we considered filtering to small vs. big before considering returns. The result for long and short strategy is as before, inflation rules :) For long only momentum the results of momentum with 3 month window that excludes last month (m.3.L) are slightly better. Yet it fails to outperform VLGI except for the last year. Further it suffers from 2 more than 4 years drawdown. So it is not a reasonable method of investing in my view.